Exchange-traded funds, or ETFs, are a popular way to invest money in 2025. They’re simple, flexible, and a great option for beginners who want to grow their wealth without needing to be finance experts. This guide will explain what ETFs are, how they work, their benefits, risks, and how you can start investing in them.

What Is an ETF?

An ETF is like a basket that holds a mix of investments, such as stocks, bonds, or other assets. When you buy a share of an ETF, you’re buying a small piece of everything in that basket. For example, an ETF might hold stocks from many companies, like Apple, Microsoft, and Amazon, all in one package.

Unlike buying individual stocks, ETFs let you invest in a wide range of companies or assets at once. This makes them a simple way to spread your money across different investments without picking each one yourself.

ETFs are traded on stock exchanges, just like individual company stocks. You can buy or sell them during the trading day through a brokerage account, and their prices change as people buy and sell.

How Do ETFs Work?

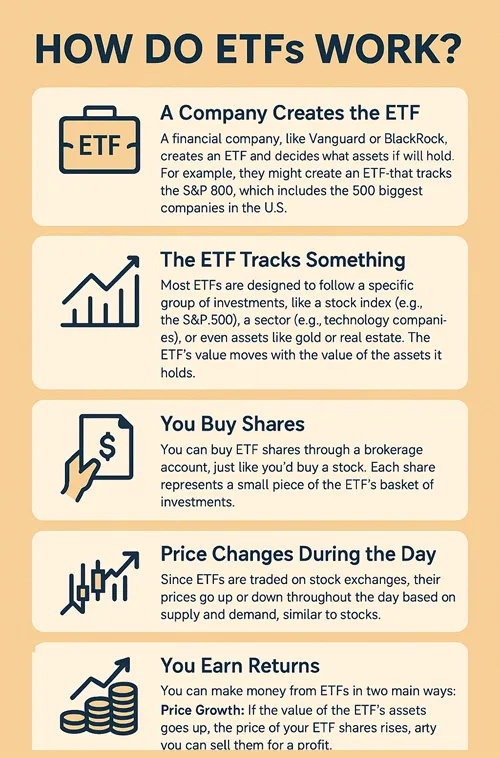

Here’s of how ETFs work:

- A Company Creates the ETF: A financial company, like Vanguard or BlackRock, creates an ETF and decides what assets it will hold. For example, they might create an ETF that tracks the S&P 500, which includes the 500 biggest companies in the U.S.

- The ETF Tracks Something: Most ETFs are designed to follow a specific group of investments, like a stock index (e.g., the S&P 500), a sector (e.g., technology companies), or even assets like gold or real estate. The ETF’s value moves with the value of the assets it holds.

- You Buy Shares: You can buy ETF shares through a brokerage account, just like you’d buy a stock. Each share represents a small piece of the ETF’s basket of investments.

- Price Changes During the Day: Since ETFs are traded on stock exchanges, their prices go up or down throughout the day based on supply and demand, similar to stocks.

- You Earn Returns: You can make money from ETFs in two main ways:

- Price Growth: If the value of the ETF’s assets goes up, the price of your ETF shares rises, and you can sell them for a profit.

- Dividends: Some ETFs pay out dividends, which are small payments from the companies in the ETF to shareholders.

Why Are ETFs Popular in 2025?

ETFs have become a go-to choice for many investors, especially beginners, because they offer several advantages:

1. Low Costs

ETFs often have lower fees than other investment options, like mutual funds. The fees, called expense ratios, are a small percentage of your investment that covers the cost of managing the ETF. In 2025, many ETFs have expense ratios as low as 0.03% to 0.1%, meaning you pay just $3 to $10 per year for every $10,000 invested.

2. Diversification

When you buy an ETF, you’re investing in many assets at once. This spreads your risk. For example, if one company in the ETF does poorly, others might do well, balancing things out. This makes ETFs less risky than buying a single stock.

3. Easy to Buy and Sell

You can buy or sell ETFs any time the stock market is open, unlike some other investments that only let you trade at the end of the day. This flexibility is great for beginners who want to stay in control.

4. Variety of Choices

In 2025, there are thousands of ETFs covering almost every type of investment. You can invest in:

- Stocks from specific countries (e.g., U.S., Europe, or emerging markets)

- Specific industries (e.g., healthcare, technology, or clean energy)

- Bonds for safer investments

- Commodities like gold or oil

- Themes like artificial intelligence or renewable energy

5. Beginner-Friendly

You don’t need to be an expert to invest in ETFs. Many ETFs are designed to simply follow a market index, so you don’t have to pick individual stocks or worry about complicated strategies.

Types of ETFs in 2025

Here are some common types of ETFs you might come across:

- Stock ETFs: These hold shares of many companies. For example, an S&P 500 ETF invests in the 500 largest U.S. companies.

- Bond ETFs: These invest in bonds, which are like loans to governments or companies. They’re often safer than stocks but may have lower returns.

- Sector ETFs: These focus on one industry, like technology, healthcare, or energy.

- International ETFs: These invest in companies from other countries, like Japan or India.

- Thematic ETFs: These focus on trends, like clean energy, artificial intelligence, or electric vehicles, which are especially popular in 2025.

- Commodity ETFs: These track the price of things like gold, silver, or oil.

- Dividend ETFs: These focus on companies that pay regular dividends, giving you a steady income.

Benefits of Investing in ETFs

- Affordable: You can start with a small amount of money, as some ETF shares cost less than $50.

- Low Risk Compared to Single Stocks: Because ETFs hold many assets, they’re less likely to lose value suddenly.

- Transparency: You can easily see what assets an ETF holds, so you know exactly what you’re investing in.

- Tax-Friendly: ETFs often have lower tax costs compared to other investments like mutual funds.

Risks of Investing in ETFs

While ETFs are generally beginner-friendly, they do come with some risks:

- Market Risk: If the market or sector the ETF tracks goes down, your investment could lose value.

- Fees Add Up: Even low fees can add up over time, especially if you invest a lot of money.

- Not All ETFs Are Simple: Some ETFs use complex strategies, like leveraged ETFs, which can be riskier and harder to understand. Stick to simple ETFs as a beginner.

- Liquidity Risk: Some less popular ETFs may be harder to buy or sell quickly, which could affect the price you get.

How to Start Investing in ETFs in 2025

Ready to try ETFs? Here’s a step-by-step guide:

- Set Your Goals: Decide why you’re investing. Are you saving for retirement, a house, or just growing your wealth? Your goals will help you choose the right ETFs.

- Open a Brokerage Account: You’ll need an account with a brokerage platform, like Fidelity, Schwab, Vanguard, or apps like Robinhood or Webull. Many of these offer commission-free ETF trading in 2025.

- Choose Your ETFs: Research ETFs that match your goals. For beginners, broad market ETFs like those tracking the S&P 500 (e.g., Vanguard’s VOO or SPDR’s SPY) are a safe start. Look at the ETF’s expense ratio, past performance, and what it invests in.

- Start Small: You don’t need a lot of money to begin. Many brokers let you buy fractional shares, so you can invest as little as $10.

- Monitor Your Investments: Check on your ETFs every few months, but don’t obsess over daily price changes. ETFs are best for long-term growth.

- Consider Dollar-Cost Averaging: This means investing a fixed amount regularly (e.g., $100 a month). It helps you buy more shares when prices are low and fewer when prices are high, reducing risk.

Popular ETFs to Consider in 2025

Here are a few beginner-friendly ETFs to explore (always do your own research before investing):

- Vanguard S&P 500 ETF (VOO): Tracks the 500 largest U.S. companies, with a low expense ratio.

- iShares Core MSCI Total International Stock ETF (IXUS): Invests in companies outside the U.S., great for global diversification.

- Invesco QQQ Trust (QQQ): Focuses on technology companies like Apple and Microsoft.

- Vanguard Total Bond Market ETF (BND): A safer option that invests in bonds.

Tips for Success with ETFs

- Start Simple: Stick to broad market ETFs until you’re comfortable with investing.

- Keep Fees Low: Choose ETFs with low expense ratios to save money over time.

- Diversify: Mix different types of ETFs (e.g., stocks and bonds) to balance risk.

- Stay Patient: ETFs are best for long-term investing. Don’t panic if the market dips.

- Learn as You Go: Use free resources like brokerage websites, financial blogs, or books to keep learning about investing.

Why ETFs Are Great for 2025

In 2025, ETFs are more popular than ever because they’re affordable, flexible, and easy to understand. Whether you’re interested in technology, clean energy, or just want a simple way to invest in the stock market, there’s an ETF for you. With low fees and the ability to start small, they’re perfect for beginners looking to build wealth over time.

If you’re new to investing, ETFs are a smart way to dip your toes into the market without taking on too much risk. By starting small, diversifying, and staying patient, you can use ETFs to work toward your financial goals.

Leave a Reply